Mexico

Visa Invests in LATAM Open Finance Platform Belvo’s US$43 Million Series A

Visa has invested in Mexico City-headquartered open finance API platform Belvo through its US$43 million Series A. The two companies have also signed a strategic partnership to jointly develop open finance solutions in Latin America, a statement from Belvo said.

Read MoreMastercard to Extend Real-Time Payments to Latin America With Arcus Acquisition

Mastercard has acquired Mexico-based Arcus Financial Intelligence to support bill pay solutions and other real-time payment applications across Latin America. Arcus provides bill pay and cash-in, cash-out services for billers, retailers, fintechs and traditional financial institutions in the US and

Read MoreMexican Credit Card Issuer Stori Closes US$200 Million in Oversubscribed Series C

Mexican credit card issuer Stori announced that it has closed US$125 million during an over-subscribed Series C funding round co-led by global venture capital firm GGV Capital and growth-stage investor GIC. Other investors include General Catalyst, Goodwater Capital, and Mexico-based

Read MoreMexican Startup Reworth Raises US$2.8 Million in Seed Funding

Reworth, a Mexico-based startup that offers API solutions so financial institutions can offer cash back to their clients, announced the closing of a US$2.8 million seed funding round. This round was led by ALLVP, with participation from New York-based FJ

Read MoreBBVA Mexico Joins Ant Group’s Blockchain-Based Trading Platform Trusple

BBVA has signed an agreement to integrate its cross-border payment and financing services on Trusple, a blockchain-based trading platform powered by Alibaba’s affiliate Ant Group, for greater transparency and security. Trusple aims to accelerate the digital transformation and facilitate the

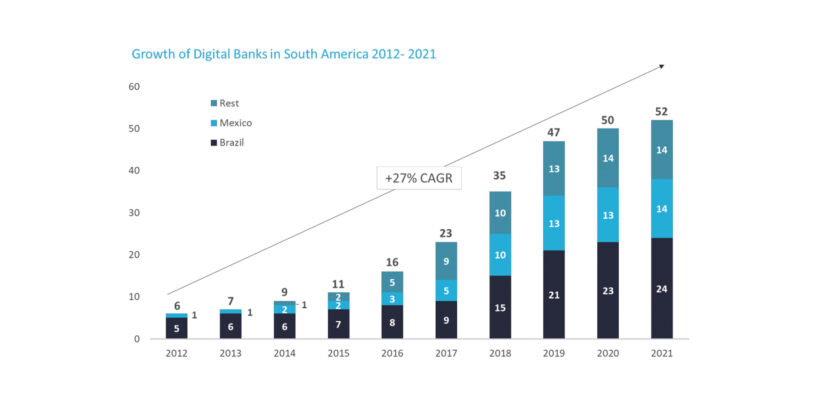

Read MoreLatin America Sees Booming Digital Banking Sector with Brazil at the Lead

Over the last few years, digital banking in Latin America (Latam) has experienced extraordinary growth on the back of changing customer needs, expanding technological penetration and rapidly evolving regulatory standards. Since 2017, the number of digital banks has more than

Read MoreBrazil and Mexico Emerge as Top Fintech Countries in Latin America

Though the growth of fintech in Latin America (Latam) started later than in other region, it quickly picked up stream. Today, Latam is experiencing an explosion of fintech activity that’s being fueled by rising demand for online banking tools, encouraging

Read MoreMexican Fintech Credijusto Acquires Banco Finterra for Under US$50 Million

Credijusto, a Mexican lending platform for small businesses, announced the acquisition of a local bank Banco Finterra which specialises in financing solutions for small businesses and the agriculture sector. According to Reuters, Credijusto acquired the regulated bank in a deal

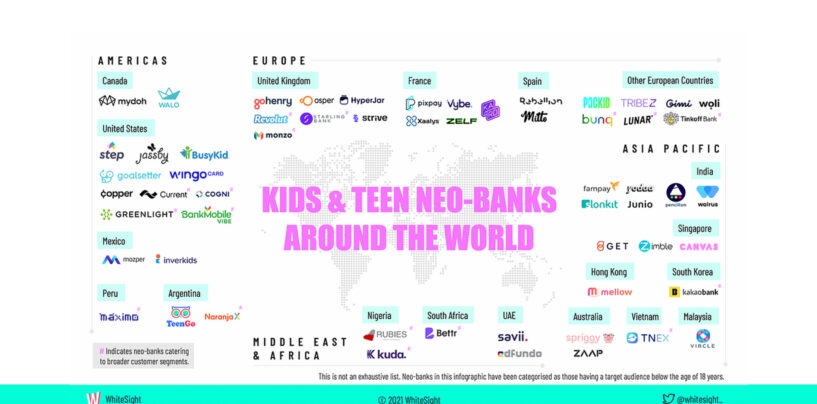

Read MoreNeobanks Come for Kids and Teens

Neobanks and digital banks have set new standards in customer experience and expectations, pushing incumbents to get out of their comfort zone and innovate. After accumulating an estimated 39 million users worldwide, neobanks are now coming after the next generation,

Read MoreAn Overview of South America’s Booming Neobanking Sector

South America has seen an exceptionally dynamic evolution of its neobanking landscape, with now more than 30 live neobanks and digital banks that serve over 50 million customers out of the region’s 430 million+ population (+11%), data from Dutch fintech

Read More