The rise of fintech in Latin America (LatAm) over the past decade has shaken up the region’s financial landscape, driving innovation in the banking sector, boosting competition and helping increase inclusion, a new paper by the International Monetary Fund (IMF) says.

In a Fintech Note released on March 29, IMF analysts look the state of fintech in LatAm, exploring how the development of the industry has impacted the region’s financial landscape and sharing the trends that are arising in the sector.

According to the paper, LatAm’s fintech industry has experienced strong growth over the past years, owing to favorable demographic factors, including the region’s large population of unbanked and underbanked, as well as digitalization efforts from governments to modernize payment infrastructures. This has led to considerable improvements, efficiency gains and increased accessibility for consumers and businesses alike.

Financial transactions that took days now can be completed instantaneously on Mexico’s Cobro Digital (CoDi), Costa Rica’s SINPE Móvil or Brazil’s Pix payment systems, the report notes, while bank services such as account opening and loan applications that were previously available only at a bank’s brick-and-mortar branches can now be done online at digital banks.

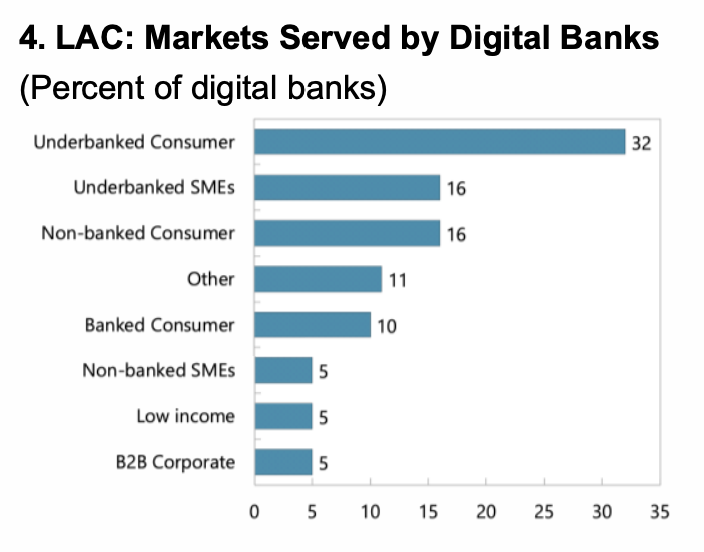

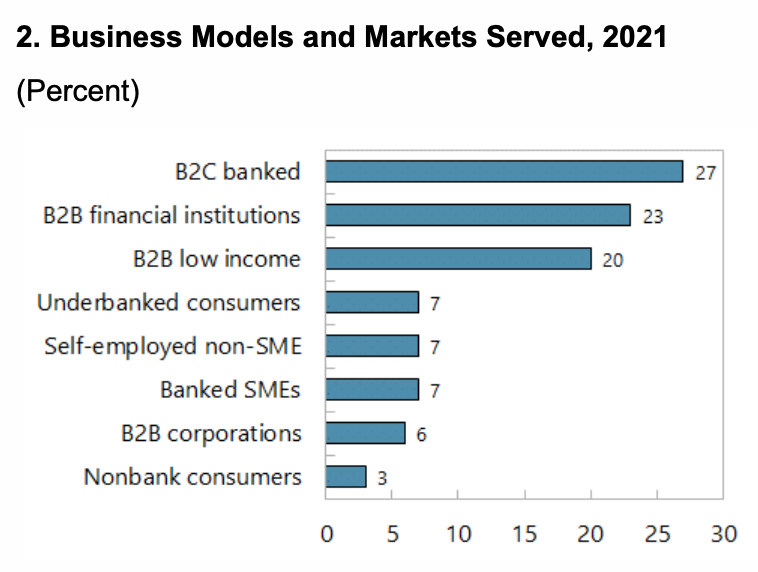

By simplifying access to financial services, fintech companies are helping increase inclusion. Today, about three-quarters of LatAm digital banks’ customers are unbanked and underbanked consumers and small and medium-sized enterprises (SMEs), and two-thirds of their loans go to these demographics, the report says.

Fintech companies are also boosting competition in the banking sector both directly and indirectly. A direct impact comes from competition between incumbents and fintech companies themselves, especially those operating in the lending sector. This has led several smaller banks to respond by decreasing their prices and interest margins, a trend that’s visible since the 2000s, the report says. Indirectly, fintech startups are providing incentives and opportunities for incumbents to invest in new fintech innovations and tap efficiency gains and offer improved customer experiences.

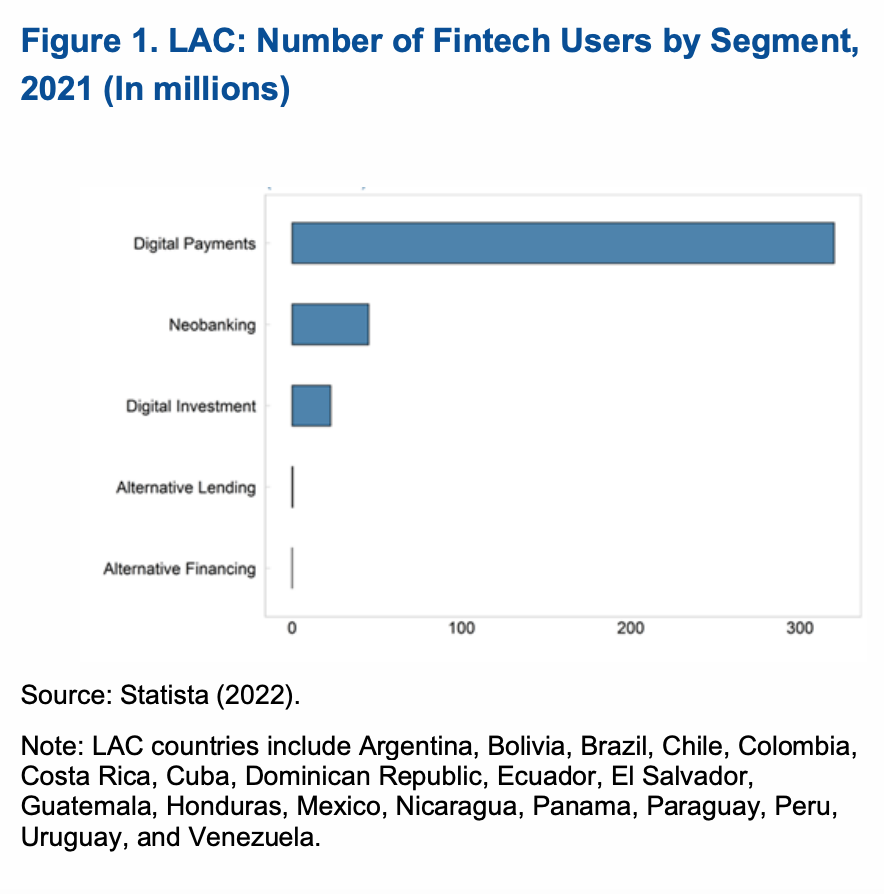

Digital payments and neobanking lead LatAm fintech industry

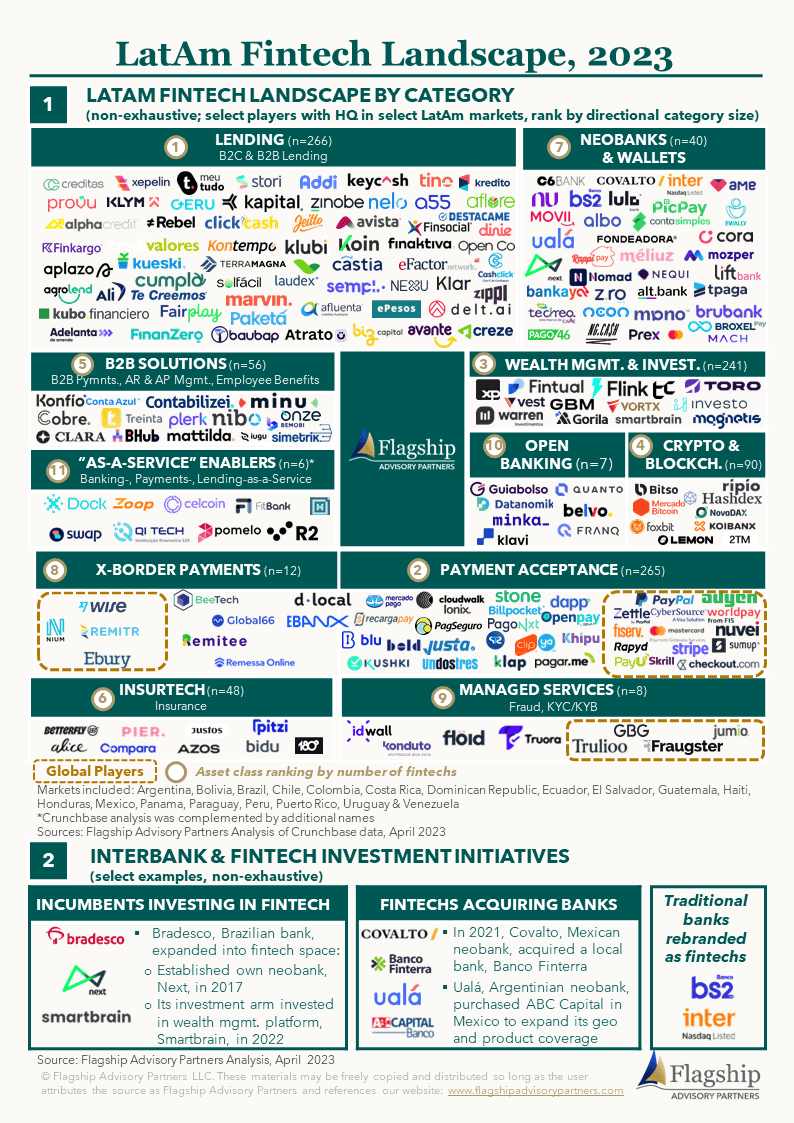

According to the paper, LatAm’s fintech industry is currently led by digital payments providers and neobanks. These two segments are the largest ones in the region, serving 300 million and 30 million users, respectively, across LatAm and the Caribbean (LAC).

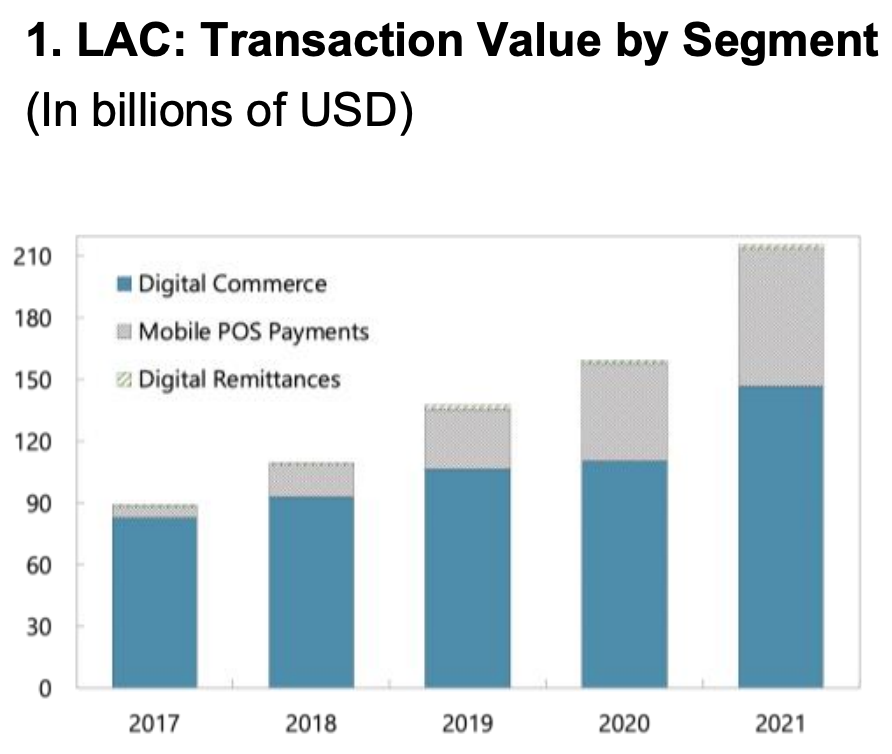

Digital payments, which grew from US$89 billion in 2017 to US$215 billion in 2021, are mostly used for e-commerce and mobile point-of-sale (mPOS), with more than 10% of e-commerce spending being now made using digital wallets, the report says.

Cross-border digital remittances is another vertical that’s picking up fast, growing almost threefold in the Caribbean and Central America and twofold in South America, it says.

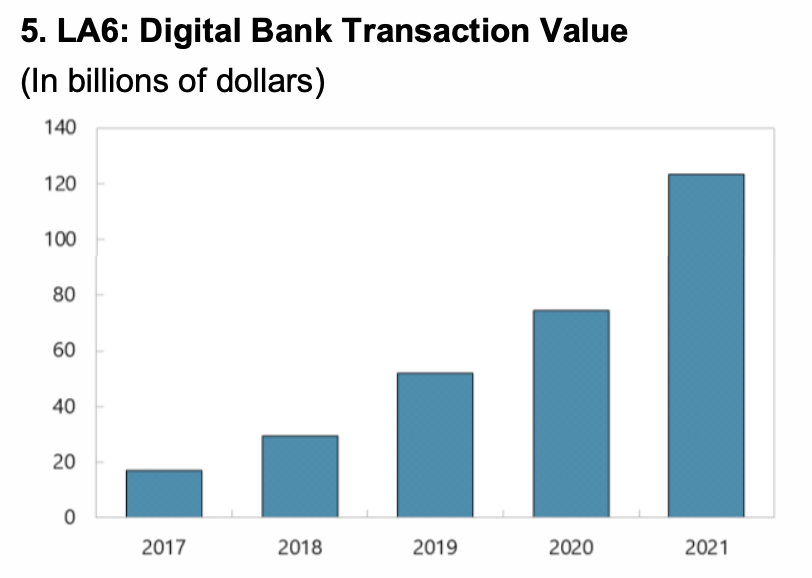

Digital banking is another prominent fintech segment in LatAm. The sector has grown from just ten neobanks in 2017 to now 60 players, with Mexico and Brazil leading the space by being home to 55 digital banks and serving most of the region’s neobanking customers.

In 2021, transaction volume of fully online digital banks in Argentina, Brazil, Chile, Colombia, Mexico and Peru (LA6) reached US$123 billion, the report says, growing more than sixfold from US$17 billion in 2017.

Alternative finance and insurtech on the rise

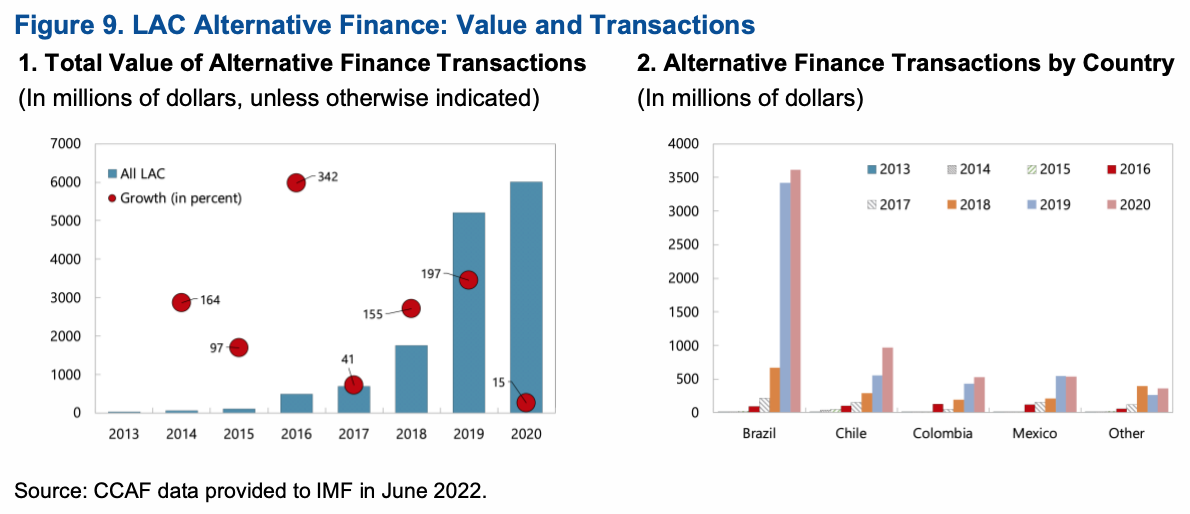

Though still relatively small compared with digital payments and neobanking, alternative finance and insurtech are two fintech verticals that are blossoming and which are creating important innovations, the report says.

Alternative finance platforms are providing new solutions to limited access to finance, allowing customers to bypass intermediaries and directly borrow from and lend to a company or a person.

Between 2017 and 2020, the volume of alternative finance in LAC expanded ninefold from US$700 million to about US$6 billion. During the period, the number of providers more than quadrupled to reach 502 in 2020, with lending platforms accounting for most of this growth. Brazil is the clear leader in alternative finance, accounting for two-thirds of volume, followed by Chile and Mexico.

LatAm’s insurtech sector, meanwhile, remains small and nascent, with just 127 companies in 2021. About half of these companies’ clients are SMEs and low-income consumers. Insurtech companies also provide technological solutions to 23% of all traditional insurance companies.

According to the report, LatAm’s insurtech industry has a strong potential for expansion, owing to low insurance penetration in the region. Rates vary from 1% of gross domestic product (GDP) in Venezuela to about 4% in Chile, the report says, compared with 9.4% in Organisation for Economic Co-operation and Development (OECD) countries.

As of April 2023, about 1,000 fintech companies were active in LatAm, according to a new report by Flagship Advisory Partners. 65% of these companies are based in either Brazil or Mexico.

Brazil is home to the six most well-funded fintech companies in the region, namely Nubank, C6 Bank, Inter and Neon, four neobanks, as well as XP Investments, an investment management company, and Creditas, a consumer lending startup.

Nubank went public in December 2021 and became LatAm’s most valuable listed bank at US$41.5 billion.

Featured image credit: Edited from Freepik