US government agencies have submitted nine reports to date in response to President Biden’s Executive Order on Ensuring Responsible Development of Digital Assets published in March 2022.

Highlights from the reports include:

Protecting consumers

1. The Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) are encouraged to “aggressively pursue investigations and enforcement actions”.

2. The Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission (FTC) should “redouble their efforts” to tackle unfair and abusive practices.

3. Government agencies such as the Financial Literacy Education Commission (FLEC) should increase research and public awareness efforts.

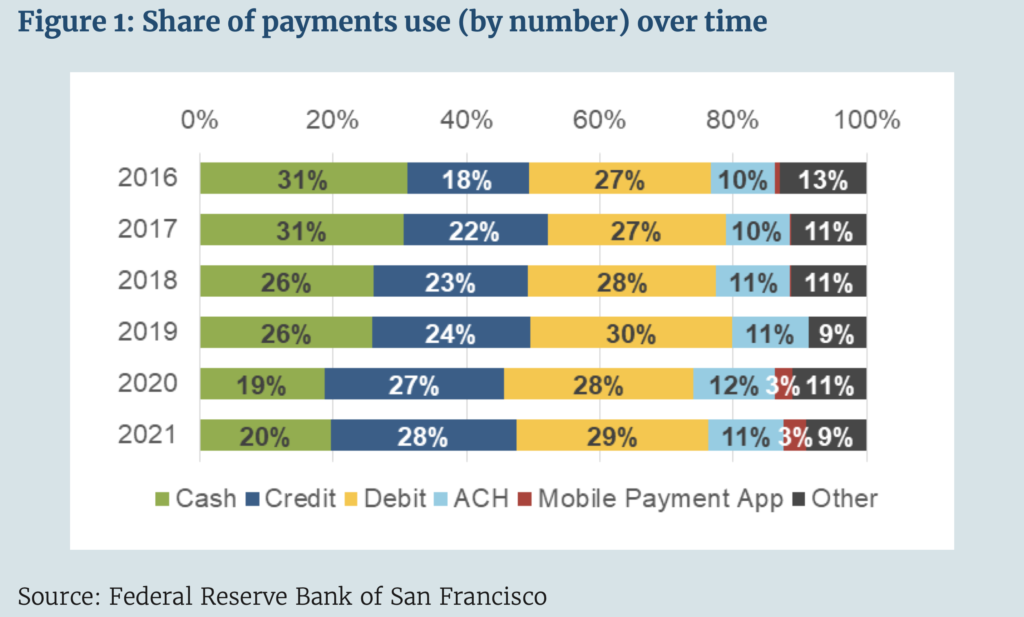

A survey conducted by the Federal Reserve reveals how consumer payment preferences may change over time or in different circumstances, as evidenced by the notable decrease in the use of cash during the COVID- 19 pandemic. Source: U.S. Department of the Treasury “The Future of Money and Payments — Report Pursuant to Section 4(b) of Executive Order 14067”

4. The Treasury will work with financial institutions to bolster their capacity to identify and mitigate cyber vulnerabilities, and help develop new technologies with regulatory guidance.

5. The Office of Science and Technology Policy (OSTP) and the National Science Foundation (NSF) will develop a Digital Assets Research and Development Agenda to support fundamental research.

6. The Department of Energy, the Environmental Protection Agency, and other agencies will consider further tracking digital assets’ environmental impacts to mitigate environmental harms.

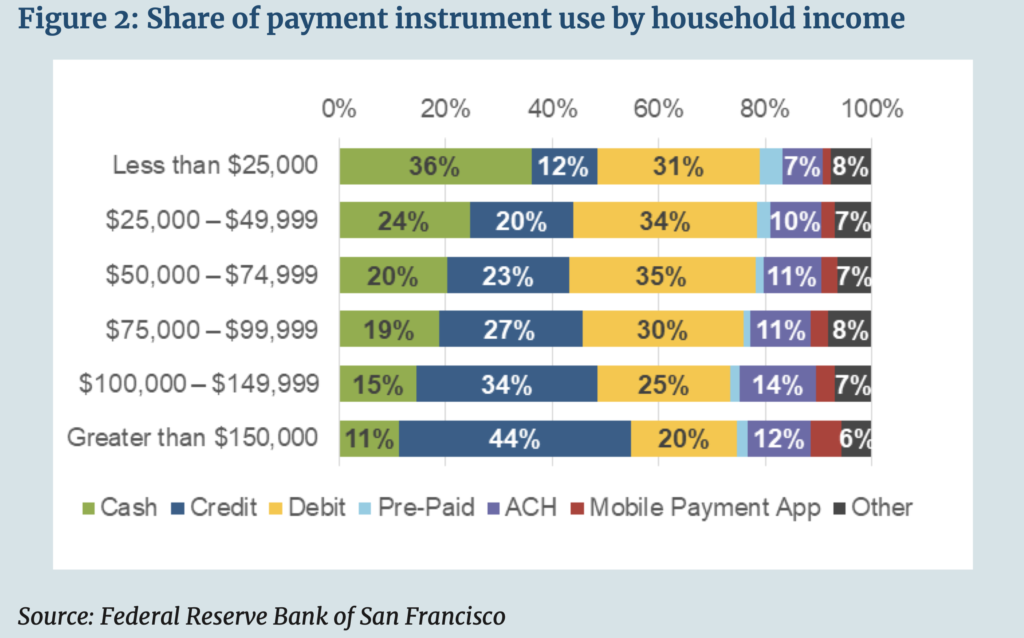

A survey conducted by the Federal Reserve provides a glimpse into the payment choices made by consumers in recent years. Source: U.S. Department of the Treasury “The Future of Money and Payments — Report Pursuant to Section 4(b) of Executive Order 14067”

7. The Federal Reserve plans to launch FedNow—an instantaneous, 24/7 interbank clearing system for instant payments—in 2023.

8. The President will consider creating a federal framework to regulate nonbank payment providers.

9. The Financial Stability Oversight Council (FSOC) will publish a report discussing digital assets’ financial-stability risks in October 2022.

Fighting illicit finance

10. The President will consider calling upon Congress to amend the Bank Secrecy Act (BSA), anti-tip-off statutes, and laws against unlicensed money transmitting to apply explicitly to digital asset service providers.

11. The President will consider urging Congress to raise the penalties for unlicensed money transmitting to match the penalties for similar crimes under other money-laundering statutes.

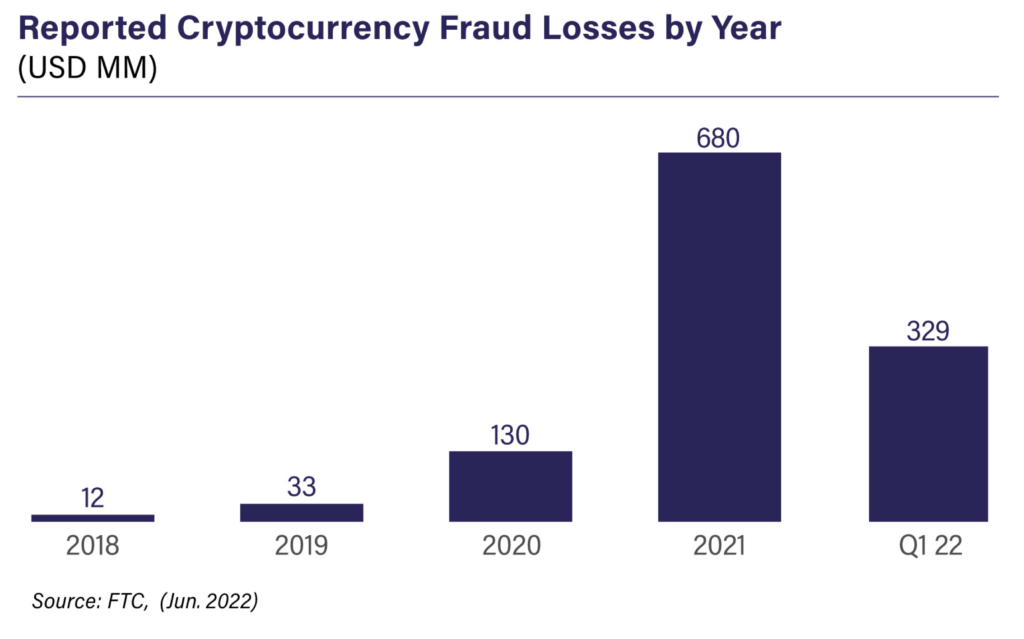

The Federal Trade Commission (FTC) had more than 46,000 reported incidents of fraud between January 1, 2021, and March 31, 2022. Source: U.S. Department of the Treasury “Crypto-Assets:

Implications for Consumers, Investors, and Businesses”

12. The President will consider urging Congress to amend relevant federal statutes to let the Department of Justice prosecute digital asset crimes in any jurisdiction where a victim of those crimes is found.

13. The Treasury will complete an illicit finance risk assessment on decentralised finance by the end of February 2023 and an assessment on non-fungible tokens by July 2023.

A digital dollar

14. The government has developed Policy Objectives for a US CBDC System, but further research and development is needed.

15. The Federal Reserve should continue its ongoing CBDC research, experimentation, and evaluation.

16. The Treasury will lead an interagency working group to consider the potential implications of a US CBDC and leverage cross-government technical expertise.

Janet Yellen

Commenting on the White House’s state on the digital asset reports, Treasury Secretary Janet Yellen said,

“The reports clearly identify the real challenges and risks of digital assets used for financial services. If these risks are mitigated, digital assets and other emerging technologies could offer significant opportunities.

These reports and their recommendations provide a strong foundation for policymakers as we work to realize the potential benefits of digital assets and to mitigate and minimise the risks.”

Brian Deese

National Economic Council Director Brian Deese and National Security Advisor Jake Sullivan said,

“Together, we are laying the groundwork for a thoughtful, comprehensive approach to mitigating digital assets’ acute risks and—where proven—harnessing their benefits.

We remain committed to working with allies, partners, and the broader digital asset community to shape the future of this ecosystem.”

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.