Lili, a mobile banking service for freelancers in the U.S., announced a US$55 million Series B investment led by Group 11, bringing total funding to US$80 million. Other notable investors included Target Global and AltaIR with previous investors re-upping.

The New York-based banking app is spearheaded by finance serial entrepreneur Lilac Bar David and is strengthening its claim as the leading banking app and finance tool for freelancers and gig-economy workers.

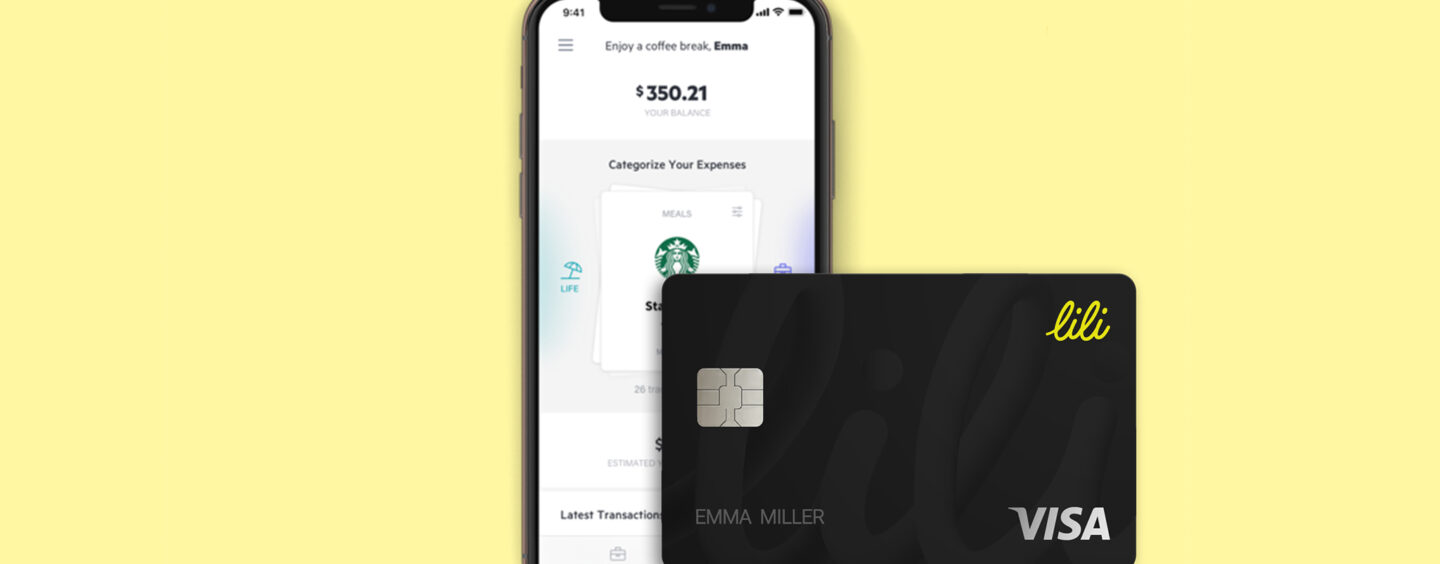

Offering relevant and timely features such as expense management, effortless tax preparation, and no-fee accounts, Lili said that it has doubled its account base in the past 6 months as more users pursue new, entrepreneurial endeavors and turn to Lili as a reliable resource for their growing businesses.

The new $55 million capital injection will allow Lili to expand the platform to address existing pain points for freelancers with new features related to invoice and payment management, as well as expanding into credit products.

Lilac Bar David

“Becoming an entrepreneur or freelancer — your own boss — is one of the most exciting life decisions you can make,”

said Lilac Bar David, CEO of Lili.

“We’ve created the tools you need to spend more time building your venture and less time on things that historically your employer would handle, sorting expenses, managing financials, and filing taxes.”

This article first appeared on fintechnews.ch