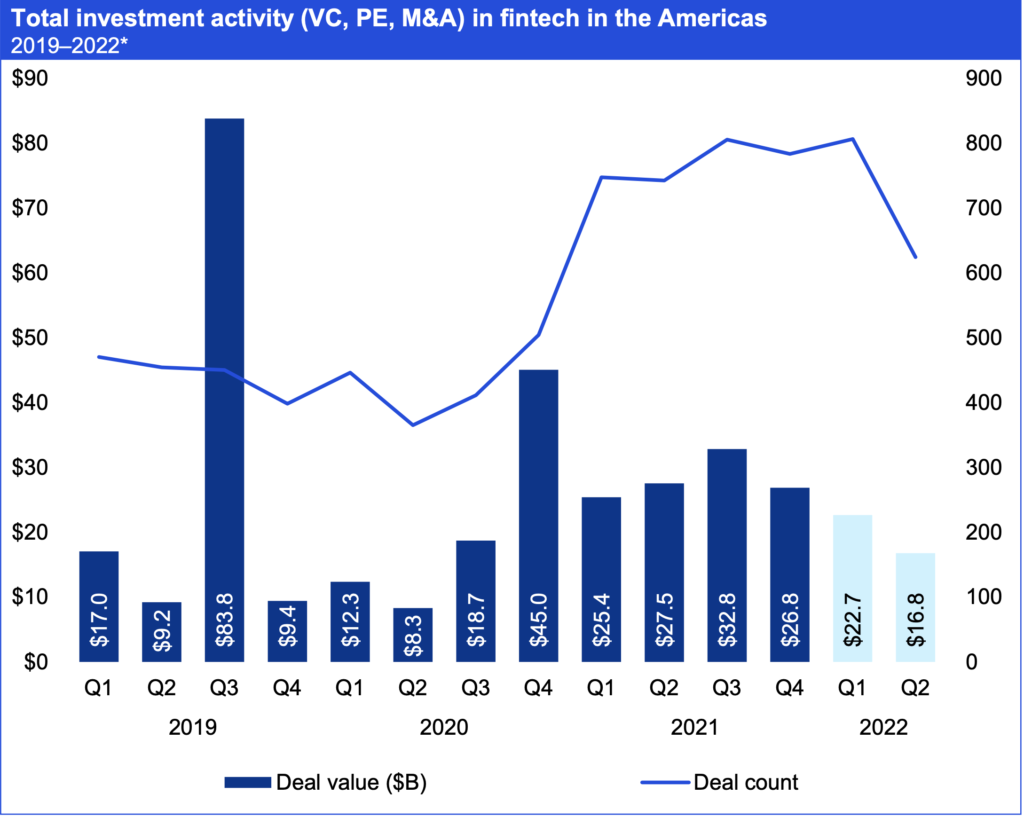

Despite a dip in quarterly investment to US$22.7 billion, the Americas saw a record 806 deals in Q1’22, according to KPMG’s Pulse of Fintech H1’22 report.

However, total investment dropped to US$16.8 billion across 624 deals in Q2’22, bringing the investment total to US$39.4 billion across 1,430 deals for the first half of the year.

Total investment activity (VC, PE, M&A) in fintech in the Americas

Key H1’22 highlights from the Americas include:

US attracts majority of fintech investment

The US accounted for US$34.9 billion of fintech investment in the Americas during H1’22, a drop from $49.7 billion in H2’22.

This included the US$2.6 billion buyout of Bottomline Technologies by PE firm Thomas Bravo, the US$1.2 billion buyout of SimpleNexus by nCino, the US$1.1 billion acquisition of Technisys by SoFi, and the US$748 million VC raise by Ramp.

Meanwhile, Brazil saw investment drop from US$3.7 billion to US$1.4 billion, while Canada saw investment fall from US$1.9 billion to US$810 million.

Investors focus on profitability and cash flow

Investors enhanced their focus on profitability, top-line revenue growth, cash flow, and the potential of companies to deliver returns given the changing market conditions.

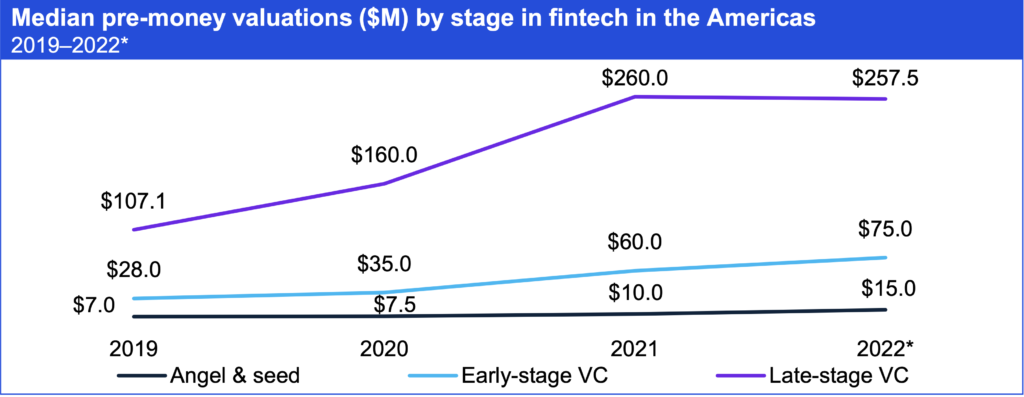

Median pre-money valuations ($M) by stage in fintech in the Americas

Declining valuations in many fintech subsectors

Given macroeconomic conditions, many public companies have seen significant downward pressure on their valuations, including many previously frothy tech companies.

While the private markets have not seen adjustments to the same degree as of yet, there could be a number of downrounds heading into H2’22 as fintechs look to raise capital given the downward pressure on valuations.

Interest in LATAM challenger banks remain strong

Within the Americas, challenger banks continued to attract attention — particularly in Latin America, where they are focusing on middle market consumers and small businesses — large populations seen as underserved historically.

Interest in challenger banks is also growing in Canada, where the banking market has long been dominated by a small number of big banks.

Top 10 fintech deals in the Americas in H1 2022

Slowdown in blockchain and crypto funding

After a record-breaking year of crypto and blockchain investment in the Americas during 2021, investment in the space slowed during H1’22.

While investment remained very strong compared to pre-2021 results, led by Bahamas-based FTX and US-based Fireblocks’ US$550 million raise, H2’22 could present more challenges for companies in the sector.

Robert Ruark

“VC and PE firms have raised a lot of money, especially in the later half of 2021, so funds are still very liquid.

As valuations come down and stabilize and investors become more comfortable with what the outlook looks like, we may see deal activity pick up, but investors are going to want to provide funding at much different valuations than they did before.

Many will also want to extract more ownership out of their investments than maybe they’ve been able to over the last year or two,”

said Robert Ruark, Principal, Financial Services Strategy and Fintech Lead at KPMG in the US.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.