Payments company Stripe has rolled out a new card issuing product in the US, allowing businesses to create, manage and distribute tailored virtual and physical cards to their customers and employees, the company announced on April 23.

Stripe Issuing is an API that allows businesses to issue cards “on a self-serving basis,” a first in the sector, John Collison, Stripe’s co-founder and president, said in an interview. These “programmatic cards” can be set up quickly and come packed with capabilities to give maximum flexibility and cater to different needs.

Zipcard, Stripe’s first customer for this offering, will be using Stripe Issuing to create credit cards that will be placed in each of its vehicles to allow renters to fill up the gas tank without having to use their personal cards.

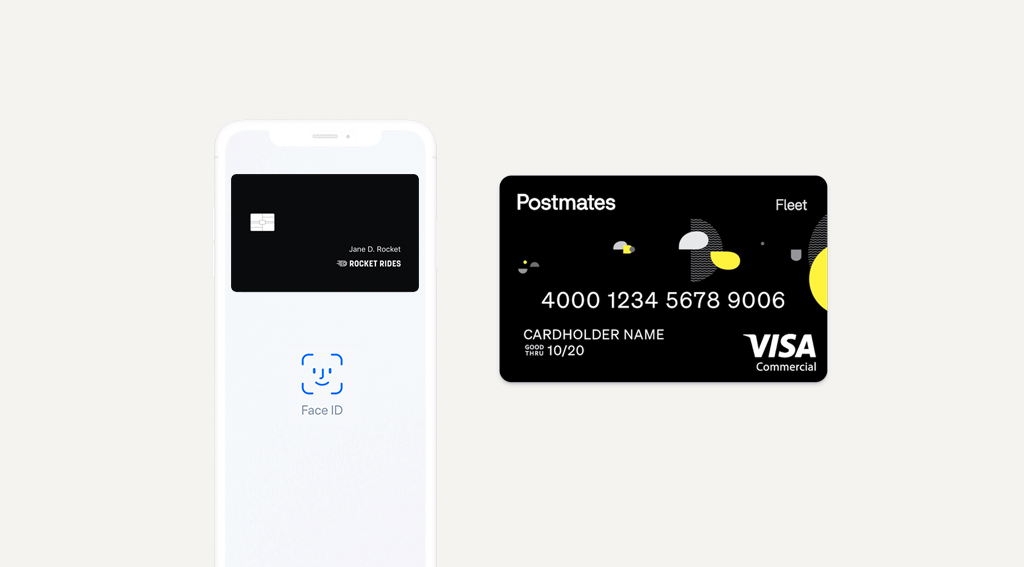

Postmates will be creating cards for its fleet of couriers. The cards will be programmed with custom spend controls that only approve transactions at the courier’s assigned merchant.

And Clearbanc, a venture capital firm, will be using Stripe Issuing to extend growth capital to startups by generating one-time virtual cards that can be used instantly—and exclusively—on online ad spend.

Other customers include NexTravel, a business travel platform, Emburse, an expense management and accounts payable automation solution, and Carrot, a digital health startup.

Stripe Issuing: how it works and how much it costs

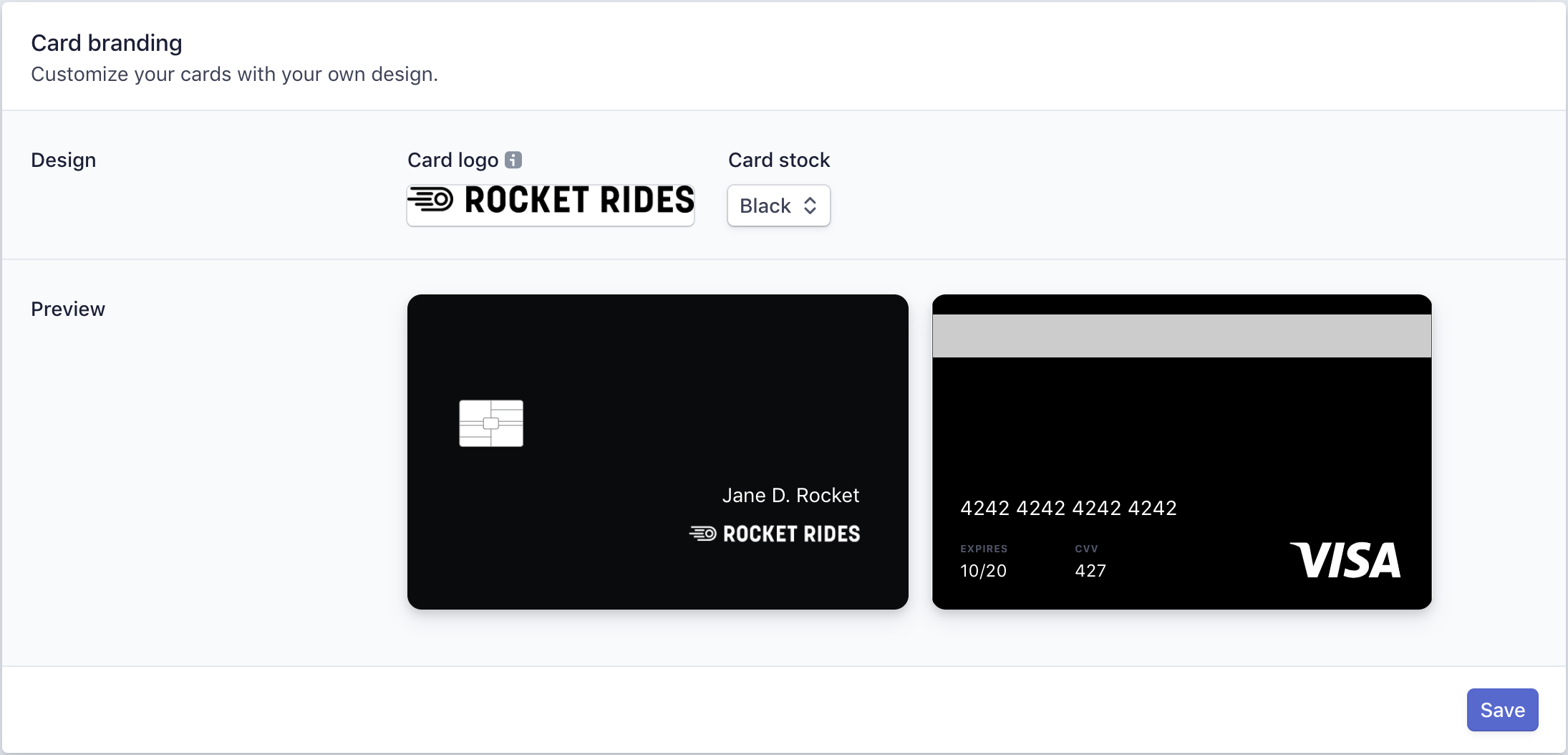

Customers activate Stripe Issuing right from their dashboard and can launch a card program instantly. Through the dashboard, they can easily create and customize their cards, set spending limits, and more. Stripe handles the card production, printing and shipping, and says it only takes two business days for customers to receive their customized card.

In terms of pricing, Stripe is charging US$0.1 for a virtual card. A branded, physical card costs US$3 (shipping included). Stripe is waiving transaction fees for the first US$500,000 in transaction volume, and after that, each card transaction will cost 0.2% + US$0.20. Custom economics are available for companies with large volume.

Stripe Issuing is currently only available to businesses in the US, but the company plans to roll out the service to other locations.

Other updates

The announcement of the new card issuing product was made simultaneously with two other major updates to Stripe’s core payments platform: worldwide direct integration with six major card networks, namely Visa, Mastercard, American Express, Discover, JCB, and China Union Pay, as well as the launch of a “revenue optimization” feature, which uses machine learning technology to minimize false card declines for businesses.

These releases were announced just a few days after Stripe announced an extension of its Series G round, raising an additional US$600 million from investors including Andreessen Horowitz, General Catalyst, GV, and Sequoia, at a US$35 billion valuation.

Moving forward, the company said it will invest further in growing its platform with additional hirings, and strategic initiatives or acquisitions. It will also deepen its stack of software functionality, and accelerate its geographic expansion with upcoming launches in Bulgaria, Cyprus, the Czech Republic, Hungary, Malta, and Romania.

Stripe has gained notable traction this year, adding industry leading firms including Caviar, Coupa, Just Eat, Keap, Lightspeed, Mattel, NBC, Paid, and most recently Zoom, as customers.

This article first appeared on fintechnews.ch